It’s been written here before.

It’s been written here before.

It’s simple, really – don’t make more than $200,000 (or $250,000 if you’re filing jointly). But since you shouldn’t be restricted to how much you make – and if you make that much, congratulations! – here’s the deal.

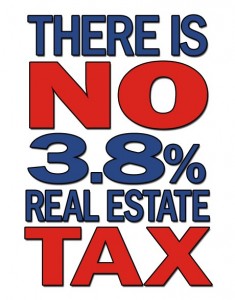

Remember that little health care debate that raged in 2010? Part of that bill had a provision that applied a 3.8% tax on unearned income for high-income taxpayers; that tax has been mistakingly labeled as a real estate transfer tax, and it’s simply not true. The truth is:

- If your total income for 2013 is less than $200000 (or $250000 on a joint tax return), you won’t be taxed an additional 3.8%.

- While there IS a 3.8% tax for high-income tax returns, it is NOT applied to real estate. Buy a house or investment property in 2013 – go ahead. You won’t be charged a 3.8% tax for doing so. Same goes for selling a house or investment property … no additional tax on your capital gains.

Now I’m not an attorney, nor am I an accountant. For a good accountant, contact Mike Tuck. But I can say with certainty that if you make less than $200,000 in 2013, you won’t be charged any additional tax. Make $201,000, and you’ll be taxed 3.8% on that $1000.

See a full breakdown of the 3.8% tax from NAR here – you’ll be the envy of all your friends because you know this stuff.

Updated 8/13/12 7:00pm – Want to dig into the numbers even more? Be my guest.