Raise the real estate tax in Montgomery County $1.5 cents in order to better fund school safety? It's being proposed.

Tag Archives: real estate taxes

Montgomery County Real Estate Assessments To Begin

Death and taxes … again. Well, one of those only happens once, but you get the drift.

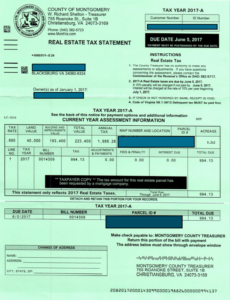

I Received A Tax Bill! Do I Pay It?

Real Estate Taxes in the New River Valley

In the last several weeks, we’ve been doing a lot of candidate tours for various colleges at Virginia Tech looking to hire new folks. Invariably, as we’re showing these prospective hires all that the New River Valley, the question always comes up – “what are real estate taxes like?”

New River Valley Real Estate Taxes

Several inquiries recently have asked about property taxes in the New River Valley, so I thought this would be an appropriate repost.

Real Estate Tax Rates in the New River Valley

Ah, taxes; and real estate taxes have certainly been a part of the discussion in Montgomery County lately (see here and here). If you’re going to own a home, however, they’re a part of the equation when making your mortgage payment every month. These amounts will vary from locality to locality, and in some cases a municipality will have TWO rates – one rate will be for the City or Town, and the other rate will be for the appropriate County. Feel free to use the phone numbers below to contact the taxing authority if you have questions.*

I Received A Tax Bill – Now What?

This afternoon, I received an email from a recent first-time buyer, who asked:

New River Valley Real Estate Tax Rates

This is a ripoff of a post I did in February 2010, but since the real estate tax rates throughout the NRV have changed a bit since then, I thought I’d update it.

New River Valley Real Estate Tax Rates

Death and taxes. Good way to start a post, right?

Real Estate Taxes In The New River Valley