As expected, the Federal Reserve raised short-term rates today. This is the first such increase they’ve made in a year, and the second in a decade. So what’s it mean for real estate mortgages?

The Federal Reserve is the bank of the United States – they regulate monetary policy, and they provide stability within the central banking system. And while an increase in short-term rates might seem to be a bad thing, it’s actually an indication that the Fed sees the US economy in positive terms, and is bringing interest rates up to better mirror inflation. While it’s true that mortgage rates will now rise – local lender Robert Mitchell of Movement Mortgage is already reporting that they’ve seen rates rise to 4.25% – the truth is that this is really a sign of an improving economy. With quoted rates effective today of 4.25% on a 30-year fixed loan, let’s run some numbers to see what the difference in today’s advertised mortgage rates look like:

$200,000 loan at yesterday’s closing rate of 4.125% – Principal & Interest payment of $969.30

$200,000 loan at today’s current rate* of 4.25% – Principal & Interest payment of $983.88

* rate pulled from www.Movement.com

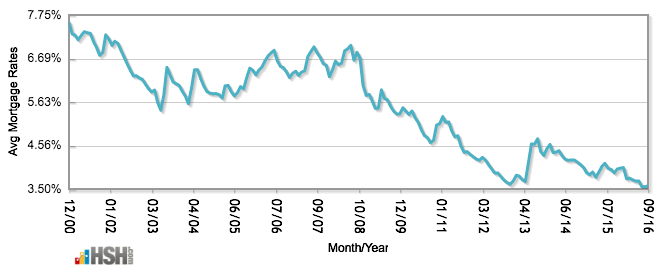

For home buyers, today’s news is going to mean a slight increase in the overall cost of a loan. Again, based on the calculations above, that cost is going to be minimal, but each hike in the Fed’s rate will mean a slight increase in the monthly cost of a home loan. And for sellers, it puts a small amount of downward pressure on you, as well – rising rates are going to keep a small number of buyers out of the market initially, but we’re predicting that’ll reset a bit as we head into the spring market. And remember – rates are still incredibly low, historically. The chart below, from HSH.com, shows 30-year conventional rates over the last 16 years.