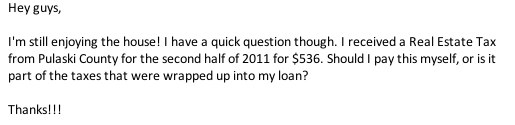

This afternoon, I received an email from a recent first-time buyer, who asked:

‘Tis the season!

‘Tis the season!

When you purchase a home, you have the option of either establishing an escrow account, or not establishing one. From an earlier post:

When you establish an escrow account with your lender, each month your mortgage payment is divided in to four parts: (1) Principal, (2) Interest, (3) Taxes and (4) Insurance.

- Principal pays down the amount of the loan.

- Interest is the interest on your loan.

- Taxes are your real estate taxes (take the yearly tax amount and divide by 12 and you’ll know your monthly tax responsibility).

- Insurance is insurance you’ll need to protect the home (the home’s value multiplied by .0025, then divided by 12 is generally a good rule of thumb, but talk to an experienced agent to get a better quote).

If you establish escrow, the prescribed amounts will be set aside each month and paid for you when the bills are submitted. Then, when your property tax bill comes in, your lender will pay it out of your escrow account. Likewise, when your insurance bill is due, your lender will pay THAT out of your escrow account, as well. But if you decided not to establish escrow <cue scary music>, you’d be responsible for paying those bills when they come due, and assuring you had the appropriate amounts in reserve.

Lenders – and municipalities – make mistakes, so if you’ve established an escrow account it’s a good idea to check in with your lender to say “hey, how ya’ doing, and by the way did you get this bill?”

Glad you’re enjoying the house, Adam.

Need a house in order to get a tax bill? This link can get you started.

Yea, it’s not real clear, is it Thud? And, to make matters worse, what happens if that note isn’t attached to the bill? Confusion abounds!

Those gub’net folks are sneaky.

This confused me, too, the first time. I got what looked like a bill but with a note attached that the same bill had been sent to my lender. A couple weeks later I looked at my lender’s online account materials and saw they’d deducted that amount from escrow. So no problem, but a good idea to keep tabs on things!