It’s inevitable – everyone wants to know how the real estate market in the New River Valley is. The truth is … so do I.

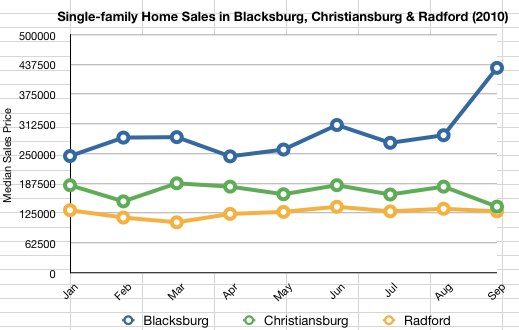

Anecdotally it seems that the market has slowed in virtually all price points, but that’s only my perspective. When you look at the median sales prices in Blacksburg (24060), Christiansburg (24073) and Radford (24141), you can see the bigger picture. The graph below shows median sales prices of single-family detached homes, month by month, over the last nine months:

Honestly, I don’t mind the values much at all. Excusing Blacksburg’s September numbers (which included four sales of $592000, $484000, $379000 and $319500), median sales prices of single-family homes haven’t varied greatly month-by-month since the beginning of the year.

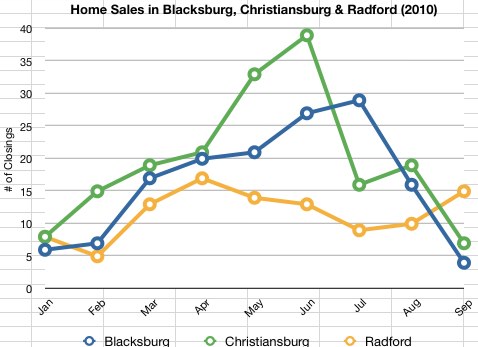

But, when you look at the number of closings in Blacksburg, Christiansburg and Radford, you can see a bit more clearly at what’s really happening in the market:

See that drop in June/July? Those two ski slopes (I’ve no idea why Radford has seen an uptick in closings since July) in Blacksburg and Christiansburg? That’s the Homebuyer Tax Credit expiration – buyers eligible for the $8000 credit had to close by the end of the day on June 30th 2010 – and since then, market activity has been … well … wonky.

What happens to real estate in the New River Valley? I think it’s slow paddling the next several months, until the job market becomes clearer, for one thing. From August:

“… in order for things to improve here locally, watch unemployment. As the unemployment numbers for the New River Valley go down, expect that consumer confidence – and the real estate market – will go up.”

Later in the week, a look at townhouse and condo sales for the year.

Thanks for this link, Brian

While stats like this are impacting a realtor and seller income, they should not impact the average buyer. If I need to buy a house I will, a driver for the “bubble” was people buying houses they didn’t need. I have been passively looking at houses for 6 months or so and would agree with the general trend, that housing is not going up. Prices in our area, which is generally economically stable, have not risen since we moved here in 2008.

A house as a lifestyle choice, and not an investment or status choice, is what I see happening. And that is not necessarily a bad thing.

Also watch corporate earnings announcements over the coming months are releases such as http://investor.owenscorning.com/phoenix.zhtml?c=71581&p=irol-newsArticle&ID=1472748&highlight=) This would indicate your trend is consistent with overall economic positioning as uncertainty exists.

I like that idea – just wonder how we could get it.

I think the data is presented in an unbiased way. We know that starting September the housing market is not as active. What would be interested is to see those closings in September, how many are affiliated with higher education – moves in or out of the region.

Thanks Dave, and welcome to the blog!

You’re right … government can’t be expected to prop us up, and I’m glad to see the market having to force itself to fix itself. It’s hard – for the industry, for home sellers – but it’s necessary in order to stabilize. I disagree that buyers need to low-ball and continue to force downward pressure on sellers, though. If fair market value is 20% of list price then that’s fair market value, but forcing sellers to sell a property out of desperation won’t serve to stabilize a market … it’ll only paralyze it.

Too utopian?

As an active house flipper in a different area, I’d like to see a comparison around here. May explain why I haven’t had a reasonable offer on my house yet. Kind of makes you wonder why they didn’t extend the tax credit program. But at the same time, the government can’t prop us up forever.

I think your assessment and analysis are right on. I honestly think that, for people looking to sell AND buy, knowing what the market is doing, IN REALITY, is important so that they can adjust expectations. As a seller, this tells me that I need to hold tight, and not expect too much for a while. I might even wish to adjust my price if I need to “get rid” of my property. As a buyer, it tells me that I need to really low-ball any property I look at. Some folks may get a bit desperate and want to just get out from their home. Guess that’s a bit of a “panicky” approach, but it’s reality. It’s funny, at least around here – lots of folks bought homes in the early 2000’s; they think they can get more than what they paid for the home back then, when in fact a reality check is that they will be lucky to get what they paid for it back then.

It seems that investor component is doing the same thing, Eric, that primary occupants are doing. Unless the numbers indicate pretty solid cash flow potential, the investors I’m working with are sitting on the sidelines. They’ve also attributed it to the higher initial cash deposits that lenders are requiring (25%), but as you know I don’t think skin in the game is a bad thing.

I would guess Radford’s numbers indicate something to do with investors buying rental property. The price range, number of closing as that lower price range and low interest rates are pushing me to that conclusion. Interesting that Blacksburg has only seen the upper price range move, no rental property valuation range movement.